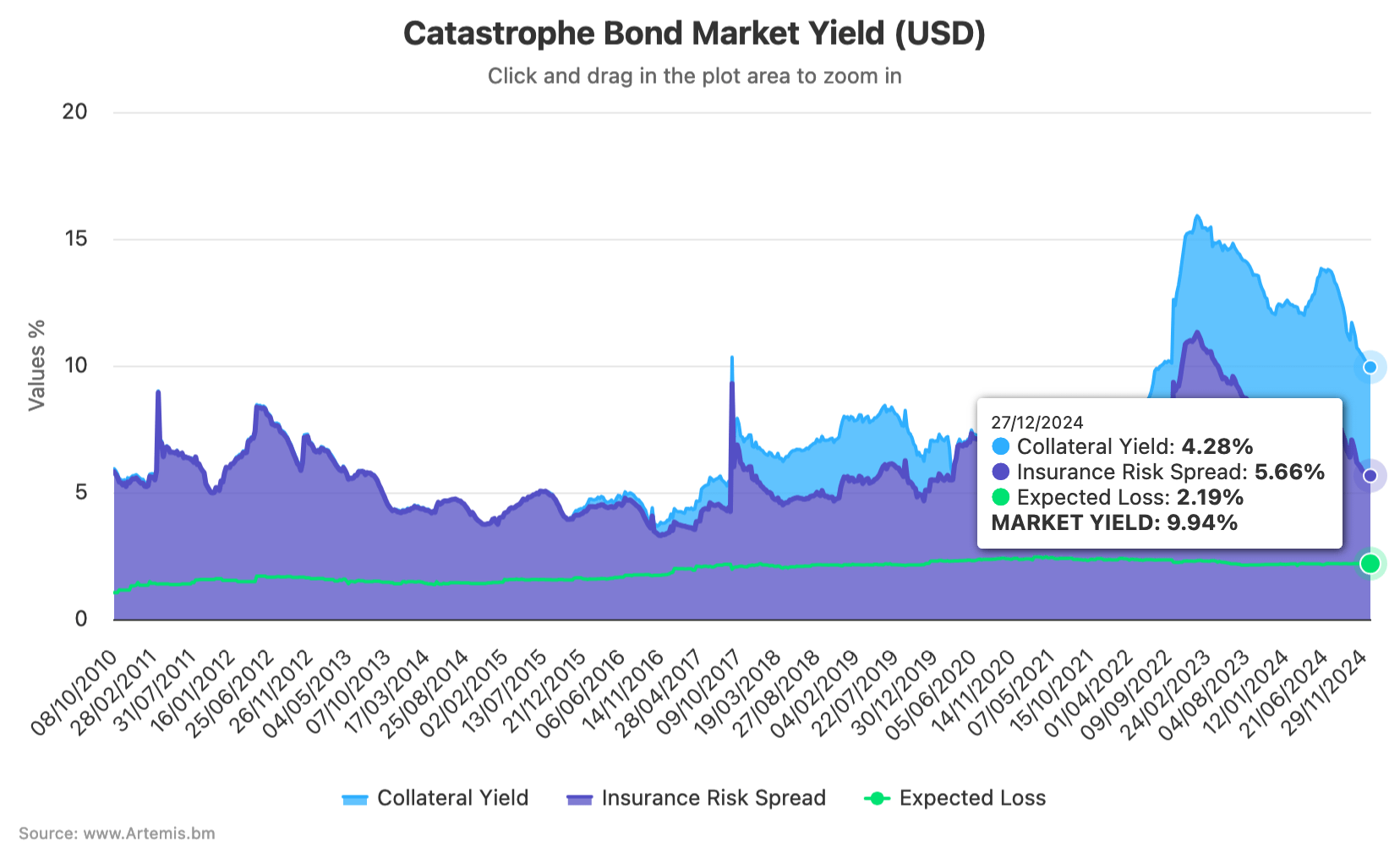

Cat bond market yield falls back into single figures at 9.94%, spreads compress on demand

High-demand for catastrophe bond investments has compressed risk spreads somewhat, resulting in the overall yield of the catastrophe bond market falling back into single digits at 9.94% by the end of December 2024, according to the latest data from Plenum Investments.The catastrophe bond market yield had demonstrated typical seasonal traits through the Atlantic hurricane season, … Read more