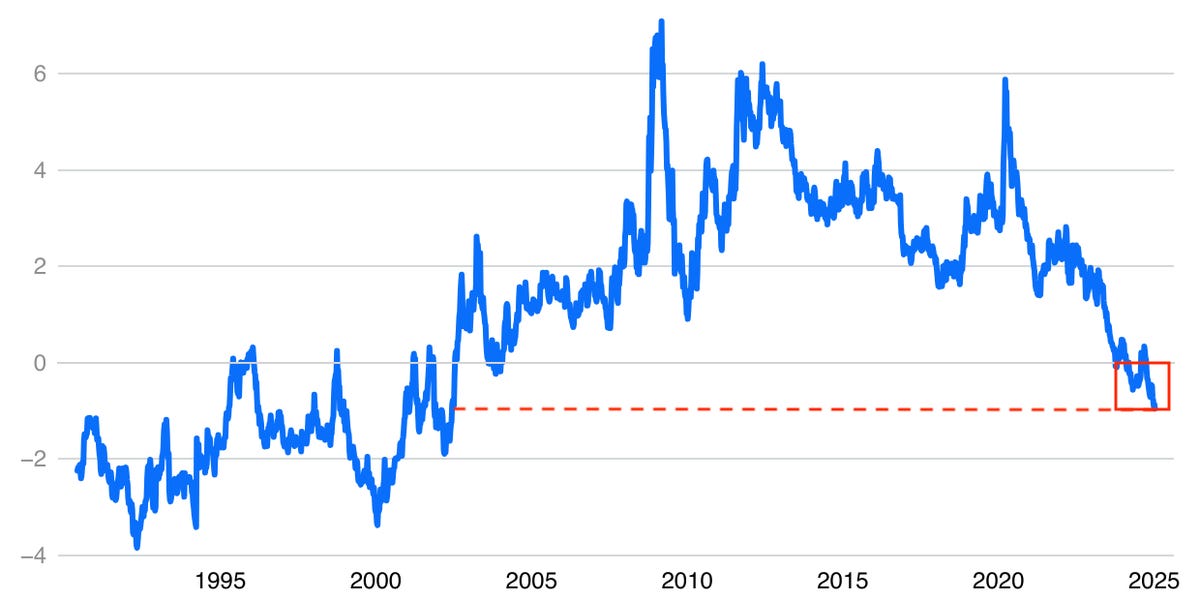

Bonds Calmed Down After Early Weakness

Bonds Calmed Down After Early Weakness 1 Hour, 37 Min ago Bonds Calmed Down After Early Weakness This week’s relevant economic data is concentrated over the Tue-Thu time frame with Wednesday’s CPI being the most obvious headliner. Today’s session offered little by way of new information but nonetheless provided some insight as … Read more